Scale your research & advisory practice

Delivers a hassle free & completely digital investing experience to your clients

Used by 100+ financial experts & businesses.

Complete investment management solution

Replace WhatsApp, CRM, Excel, contract notes, billing software, etc. with a single comprehensive solution

Offer branded & personalized investing experience

Build your brand with a beautifully designed and customizable website for clients to access your portfolios

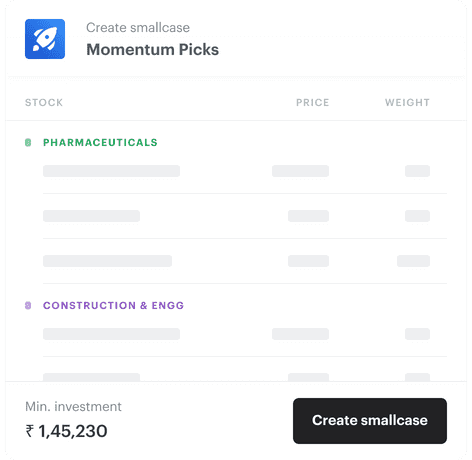

Create and manage portfolios digitally through our custom designed module in less than 5 minutes

Invest time in research, not operations

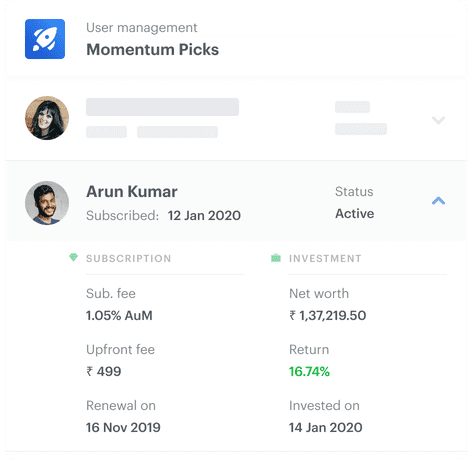

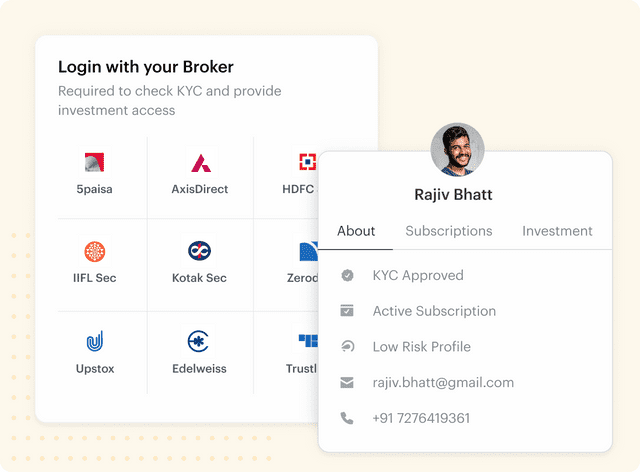

Complete subscriber management solution on website with billing, payment, risk profiling, broker connect & more

Seamless portfolio investing, tracking and management experience for your clients across top brokers

smallcases have a lot of advantages over conventional DIY portfolios like 1-click rebalance, back-end accounting of dividends, auto-calculating entry position sizes & no hassle of google sheets

Alok Jain

Founder WeekendInvesting

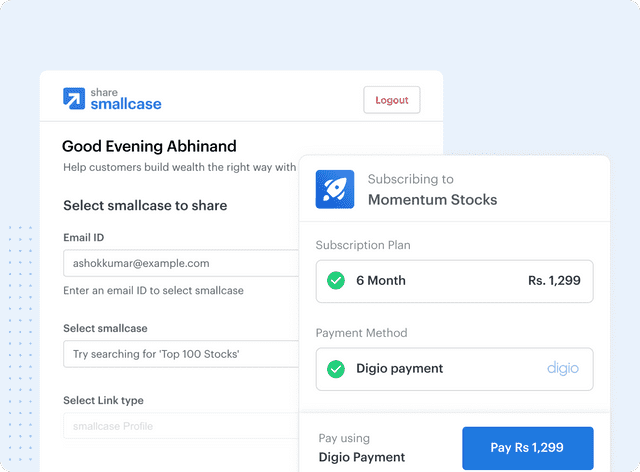

Scale your business with partnerships

Get access to in-built referral module and build your own distribution network using the smallcase share platform

Create and run custom campaigns directly through the Publisher platform to keep your clients engaged

smallcase deserves applause for transforming the industry. Its user-friendly platform enables us to dedicate more time to research, offering investors a smooth and direct investment journey.

Arvind Kothari

Founder Niveshaay

Join our community of leading financial experts using smallcase Publisher platform

Used by 100+ professionals

See allFor referrers,

Do you work with clients who would be interested in these portfolios?

Get on-boarded as a referrer and start earning

Integrated RM Management

Manage and track performance of your relationship managers

Easy Business Tracking

Track fee, networth, PnL and other client details. Access revenue and growth reports

Frequently asked questions

For Businesses

Publishers can publish two types of smallcases:

- Public smallcase – The stocks & weights would be visible to any user of our partner brokers after they login with their broker credentials.

- Private smallcase – Publishers can control access to their portfolio by publishing a private smallcase. Here, the stocks & weights are visible only to those users who have subscribed to the Publisher’s portfolios.

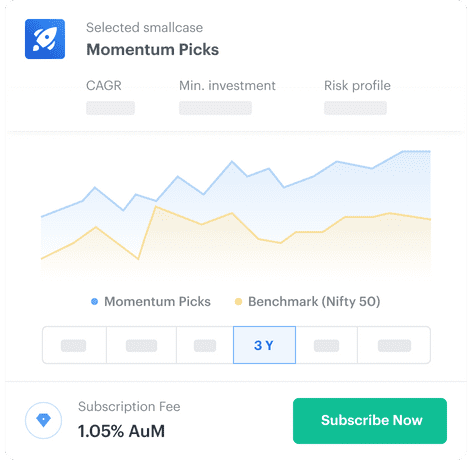

Information like CAGR, rationale, past-performance is visible to everyone in case of both private & public smallcases, to help them make an informed decision.

In addition to publishing your portfolios as smallcases, you can also add rebalances to them.

Managers also have an option to create a smallcase without prescribing any weights

All the smallcases published by you (public & private) will be visible on a dedicated website which would have your custom branding & content.

The relevant financial ratios like CAGR, risk-label, past performance for each smallcase would be visible on their respective smallcase profile.

Publisher platform automates the complete subscription flow: broker authentication that helps with KYC, payment collection, GST compliant invoice generation and relevant emailers (rebalance, subscription confirmation, etc.)

On the Publisher platform, you will be able to track your client’s performance - Networth & PnL. Furthermore, this info is auto-updated after clients invest in your smallcases and requires no manual inputs.

Publisher also acts as an end-to-end subscription management tool with features like auto-unsubscribe after subscription expiry, auto-renewal, reminder emails, etc.

We support two pricing models on our platform:

- Flat fee : A fixed upfront amount can be charged for different frequencies i.e. monthly, quarterly, semi-annual and annual. You can also choose the renewal type you want to offer for your plans, we support both one time and auto renewal

- AuA fee: In the AuA model, Managers can charge an annualised fee (percentage of the client’s AuA) billed monthly on their average holdings. AuA fee is only supported on auto-renewals.

For Clients

In conventional portfolios, clients have to punch in trade for each stock and track them individually using the portfolio spreadsheet shared by you as reference. smallcase eliminates this hassle by enabling seamless single-click execution, automated rebalance emailers, order generation, setting up a SIP as well as portfolio tracking.

For private smallcases, clients can subscribe to your smallcases directly from the website and get instant investment access. For public smallcases, clients can login with their broker credentials and invest in the smallcase on a dedicated smallcase platform inside their broker.

Your existing clients can be provided access to invest in the private smallcases directly through the publisher platform. Also, there is an added functionality where the clients’ current broker holdings can be migrated to smallcases

We have an extensive coverage of partner brokers – Zerodha, HDFC Securities, Axis Direct, Kotak Securities, Alice Blue, 5 Paisa, Edelweiss, IIFL Securities, Trustline and Upstox

Through the publisher platform, you can create multiple subscription plans. Your users can subscribe to these plans from the website itself.

Your subscription (advisory) fees paid by the user will be directly settled to your bank account.

smallcase charges are dependent on the client’s broker. The charges for different brokers can be found here - Zerodha pricing, 5paisa pricing, Axis pricing, Edelweiss pricing, Kotak pricing, HDFC Pricing, Aliceblue pricing, IIFL pricing, Trustline pricing &, Upstox pricing

These charges are separate from the subscription fees that your users will pay.

About smallcase

It is a portfolio of stocks and/or ETFs that tracks a theme, strategy or objective. It is:

- Effortless – single click portfolio execution and rebalancing

- Consolidated – tracking at portfolio level

- Transparent – complete visibility over holdings

- Complete Control – No lock-in; add/remove stocks anytime

The stocks are owned by investors directly in their demat account.

When you buy a smallcase, the portfolio value is set to 100 on the buy day - this helps you track the total returns without having to monitor each stock. You can also use the performance metrics to get a more detailed understanding of your smallcase.

Rebalancing is the process of reviewing the stocks/ETFs of a smallcase to ensure that it continues to reflect the underlying original idea. It takes into account fundamental factors,company updates, etc. to objectively narrow down on the right constituents.

Rebalancing is done by the research team/creator of the smallcase as per its schedule. It is not an automatic process; you would be notified via email when a smallcase you have invested in has a rebalance update available. You can review the changes and apply the update in 2 clicks.

Great tool that allows customers of our portfolio research services to seamlessly execute with their broker, and to rebalance periodically. Our clients are happy with the simplicity & UX.

Deepak Shenoy

Founder Capitalmind